Institutional Lending - Client Experience

For clients, loan requests and approvals were opaque and slow, with no visibility into timelines or updates—leading to uncertainty and frustration.

I redesigned the experience to provide clear touchpoints, proactive alerts, and real-time updates, giving clients faster, transparent, and more reliable loan interactions.

PROBLEM

A Fragmented, Stressful Experience for Clients

Clients faced challenges both before and after loan approval.

Before and during the loan application: They had no clarity on where their application stood, missed document signature requests, creating uncertainty and delays.

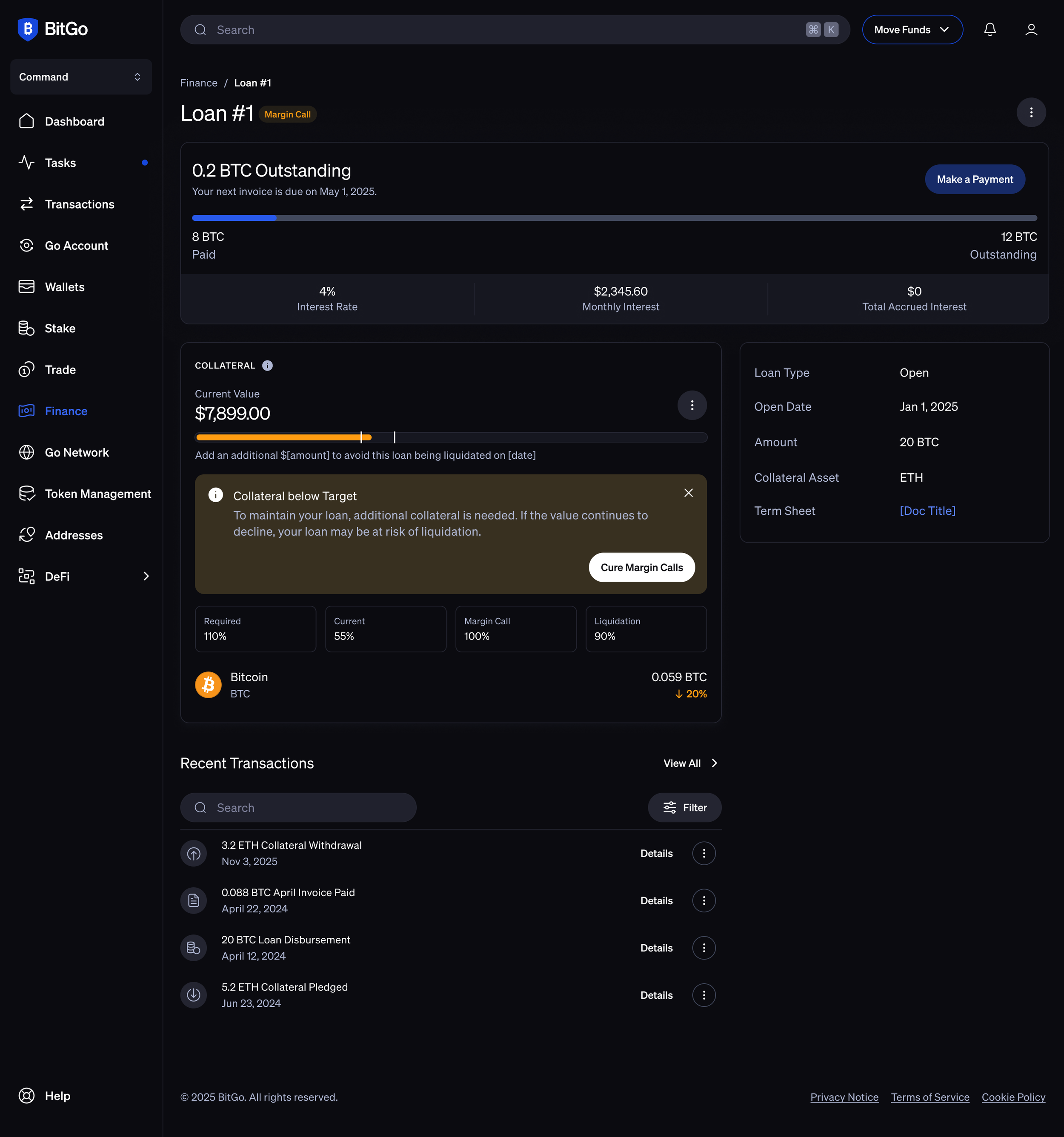

After loan approval: They were often caught by surprise by margin calls, and lacked visibility into loan monitoring and next steps, leaving them reactive and unsure about managing their loans.

GOAL

A Transparent and Proactive Client Experience

Provide clients with end-to-end visibility and guidance throughout the loan journey—from application to post-approval—so they can stay informed, act promptly, and manage their loans confidently.

My role

As the lead product designer on this initiative, I was responsible for designing both the client experience and the internal admin platform for BitGo Borrow. I worked cross-functionally with product, engineering, legal, and compliance teams to map out real-world workflows and translate them into scalable UI flows. My work included journey mapping, designing request and approval flows, managing loan states, and aligning the product with BitGo’s existing design system. I also partnered with internal stakeholders to reduce friction in day-to-day admin processes, making previously manual tasks intuitive and auditable within the tool.

Kickoff

-

Mapping existing workflow

Interviewed internal users to understand how lending was handled via Slack, spreadsheets, and emails. Identified key pain points and mapped the end-to-end process to inform product requirements.

-

Defined End-to-End Flows

Designed the full lifecycle of a loan from both the client and admin perspectives which included loan requests, approvals, agreement tracking, funding, repayments, and status updates.

-

Stakeholder validation

Conducted design reviews with product, engineering, admin, and compliance teams. Incorporated feedback to refine flows, cover edge cases, and ensure the solution met real-world operational and regulatory needs.

Discovery

To understand client pain points, I conducted user interviews and feedback sessions with clients, as well as admins, operations, legal, and security teams to get the full picture and inform the end-to-end workflow.

These conversations focused on uncovering friction points before, during, and after the loan application, such as missed communications, surprise margin calls, and lack of clarity on application status or next steps. Insights from these sessions helped identify critical opportunities for proactive visibility, timely alerts, and a transparent, guided experience throughout the loan journey.

USER INSIGHTS

USERS WANTED

Transparency

on their loan health, progress and status

without waiting for an email

USERS WANTED

Proactive alerts

for real-time visibility into loan status

and collateral health

USERS WANTED

Clarity

on loan terms, invoice payments, collateral requirements

BUSINESS INSIGHTS

BUSINESS WANTED

Competitive

loan approval cycles from ~2 weeks down to 3 days max.

BUSINESS WANTED

Compliant

and risk free approach to enable clients and admins to facilitate loan lending and monitoring

BUSINESS WANTED

Transparency

to gain back user trust and business

KPIs & Impact

Strategic & Business Impact

Turned a manual, service-based lending process into a scalable product, unlocking new revenue potential and enabling faster, more compliant loan operations for institutional clients.

THE APPROACH

USER JOURNEY - FUTURE STATE

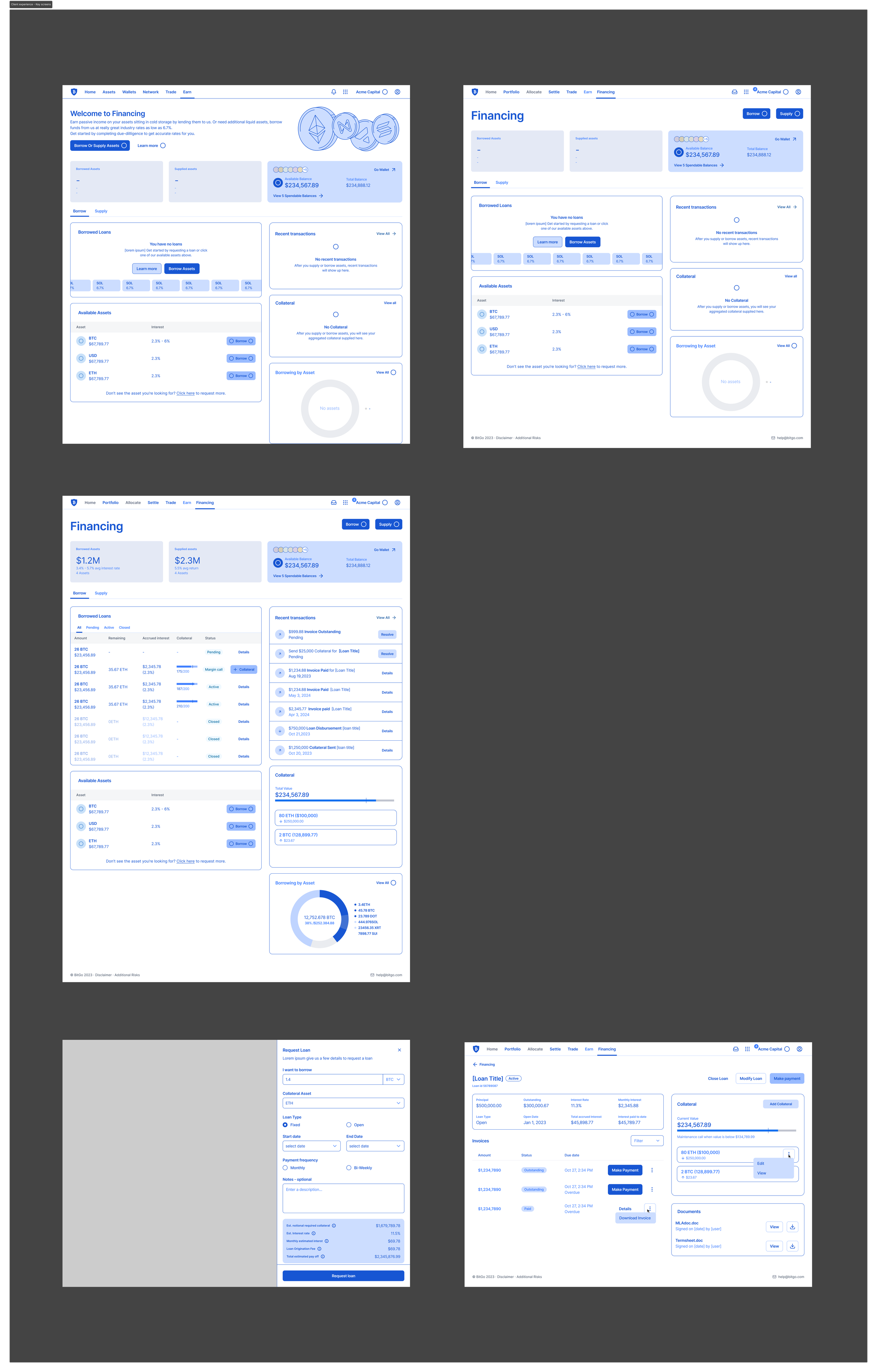

Client Experience - Wireframes

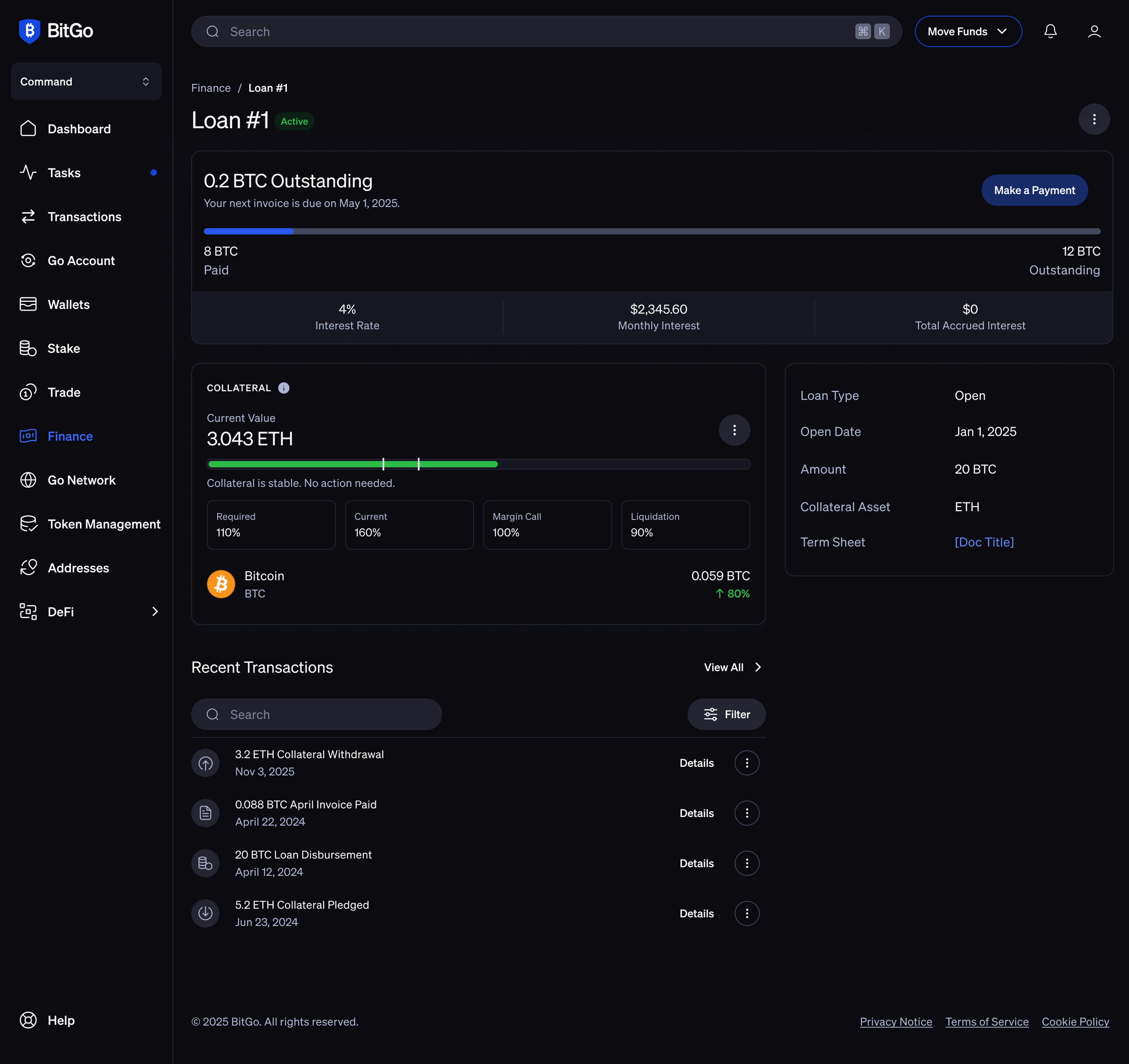

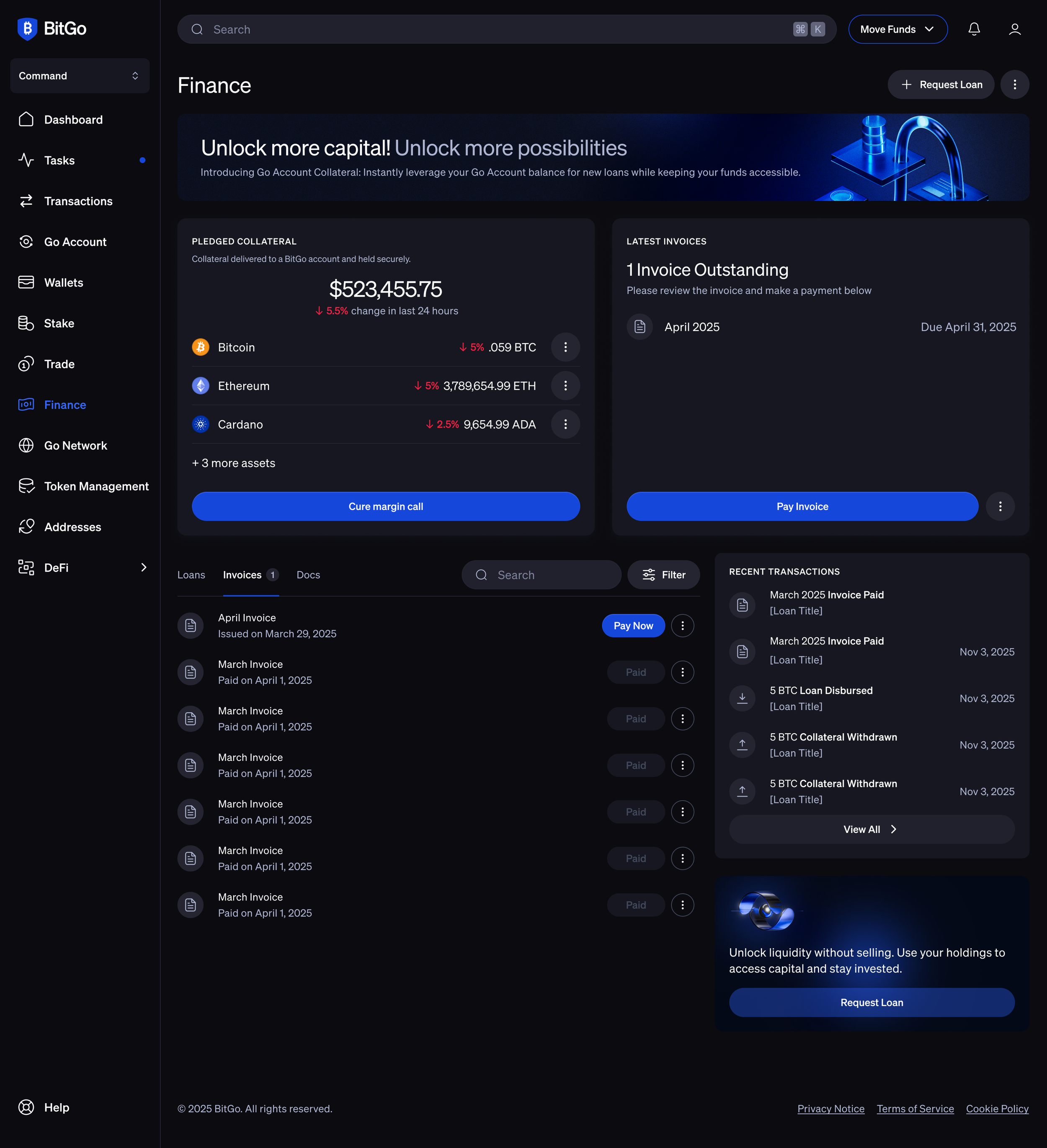

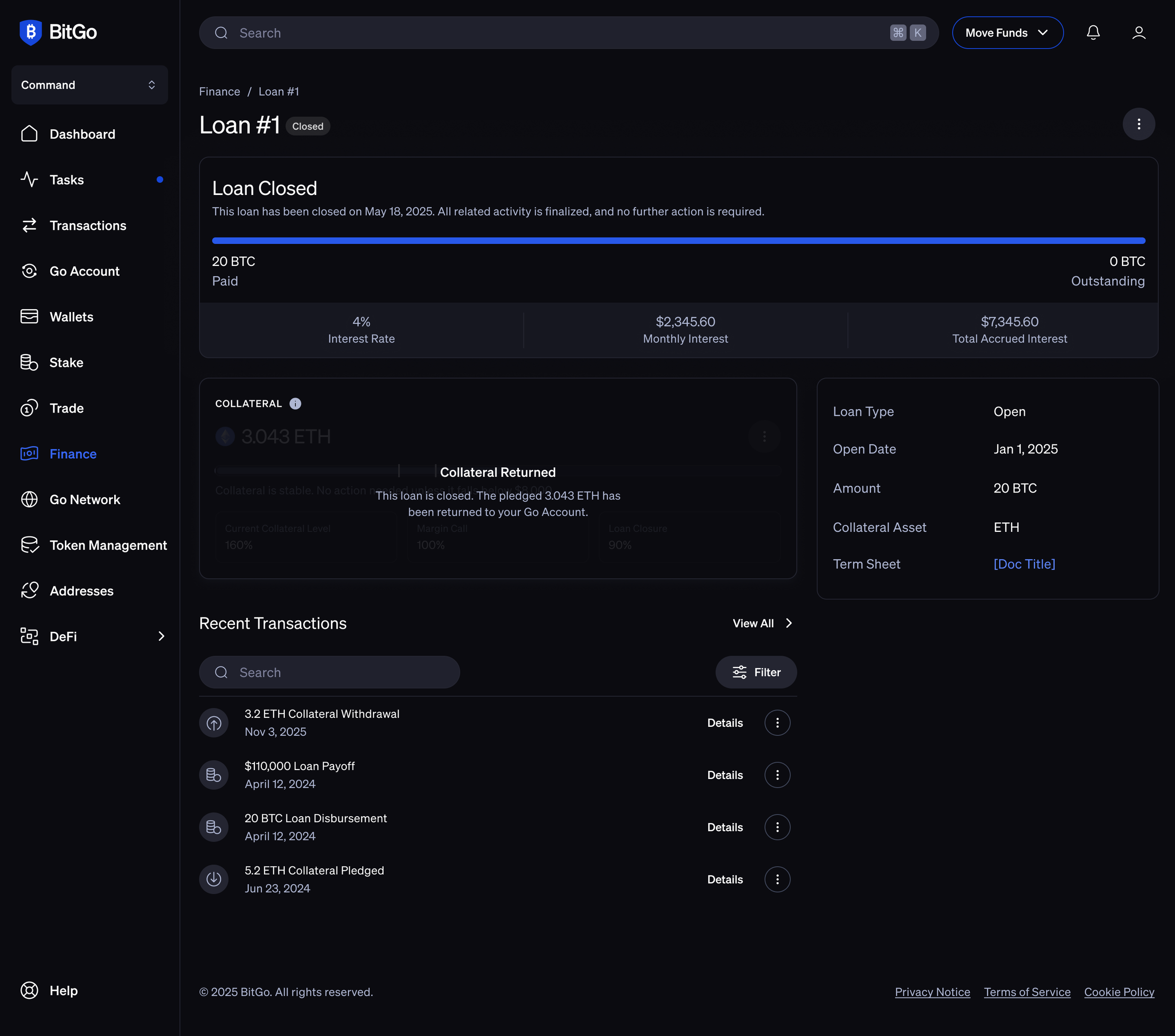

The client-side experience was designed to enable institutional borrowers to easily request and manage loans within a secure, guided interface. The wireframes show key touchpoints including Loan Overview Dashboard and Loan Details Page.

ITERATIONS & TRADE OFFS

Iterating Based on Real User Feedback

By testing early prototypes and workflows, we were able to iterate quickly, validate assumptions, and refine the solution to align with what users actually needed, ensuring the final experience was both intuitive and effective.

Due Diligence Form Removal

Impact: Reduced upfront friction for users while keeping compliance and security checks intact.

Multiple Loan Invoices

Impact: Reduced administrative overhead for clients

LAST MINUTE PIVOTS

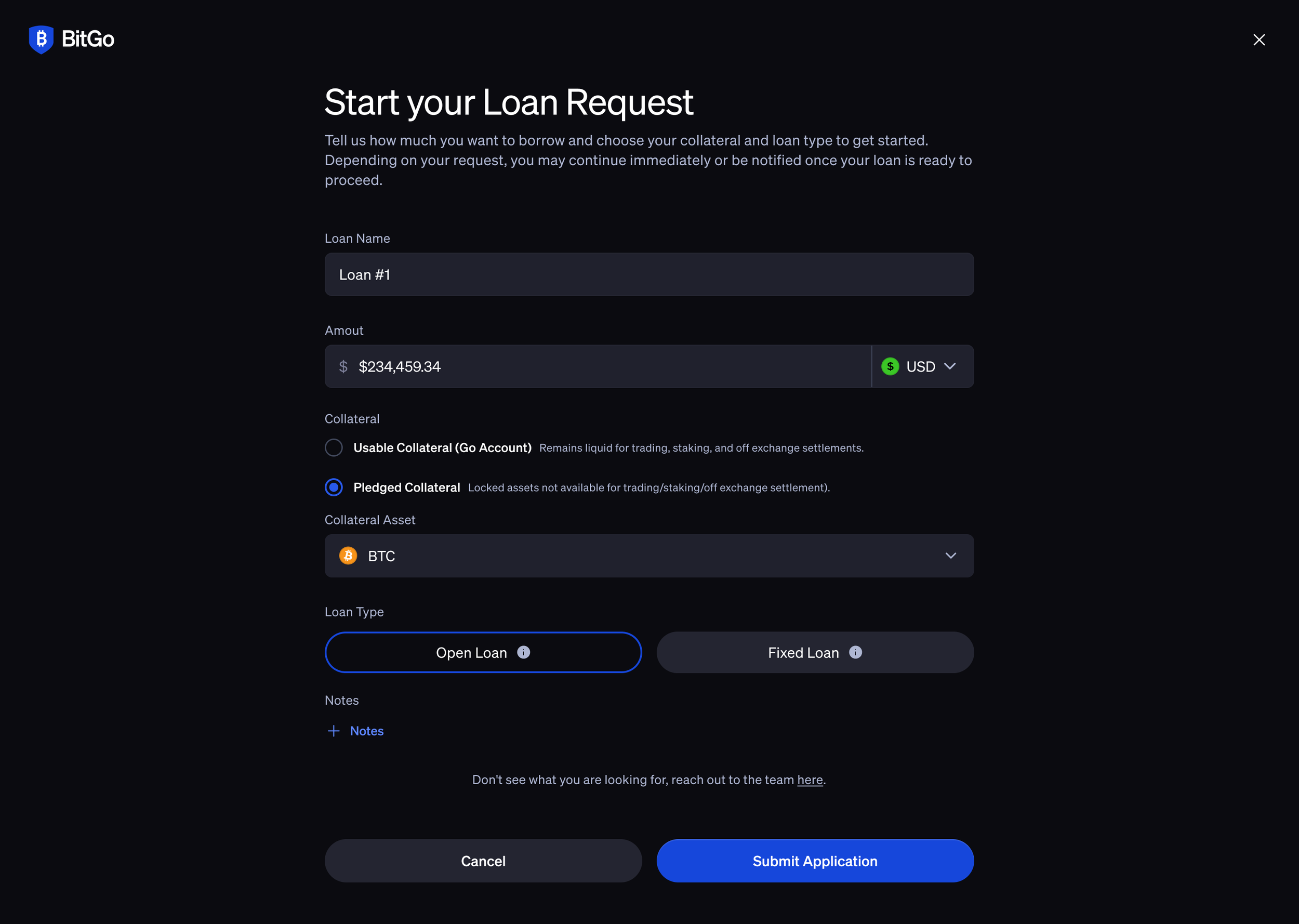

Turning Early Drop-Off into Engagement

Insight: 27% drop-off at the “Start Loan Application” step

Data driven decision: Introduce a Loan calculator

Impact: More loans originated. Improved user trust and perception of transparency.

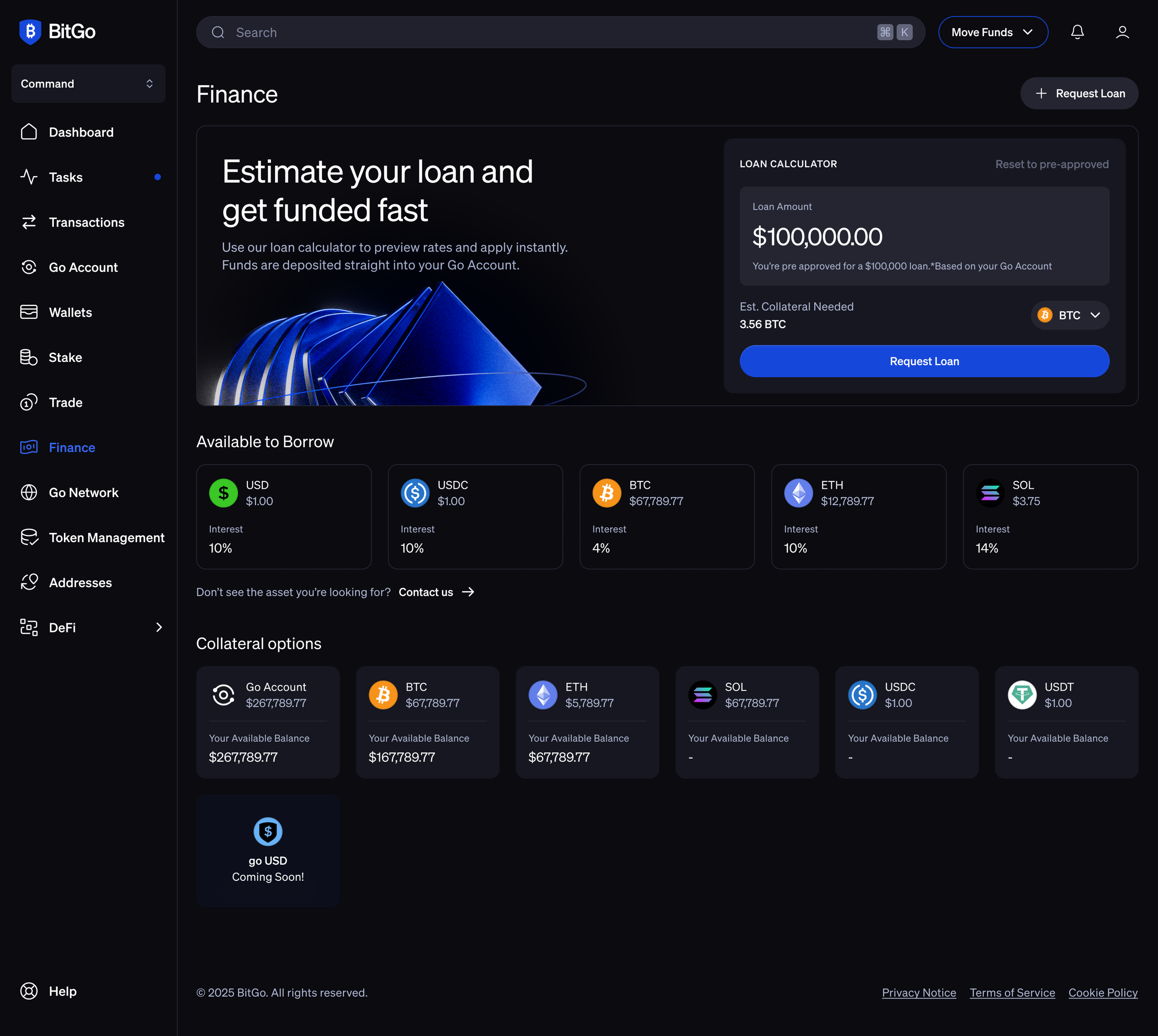

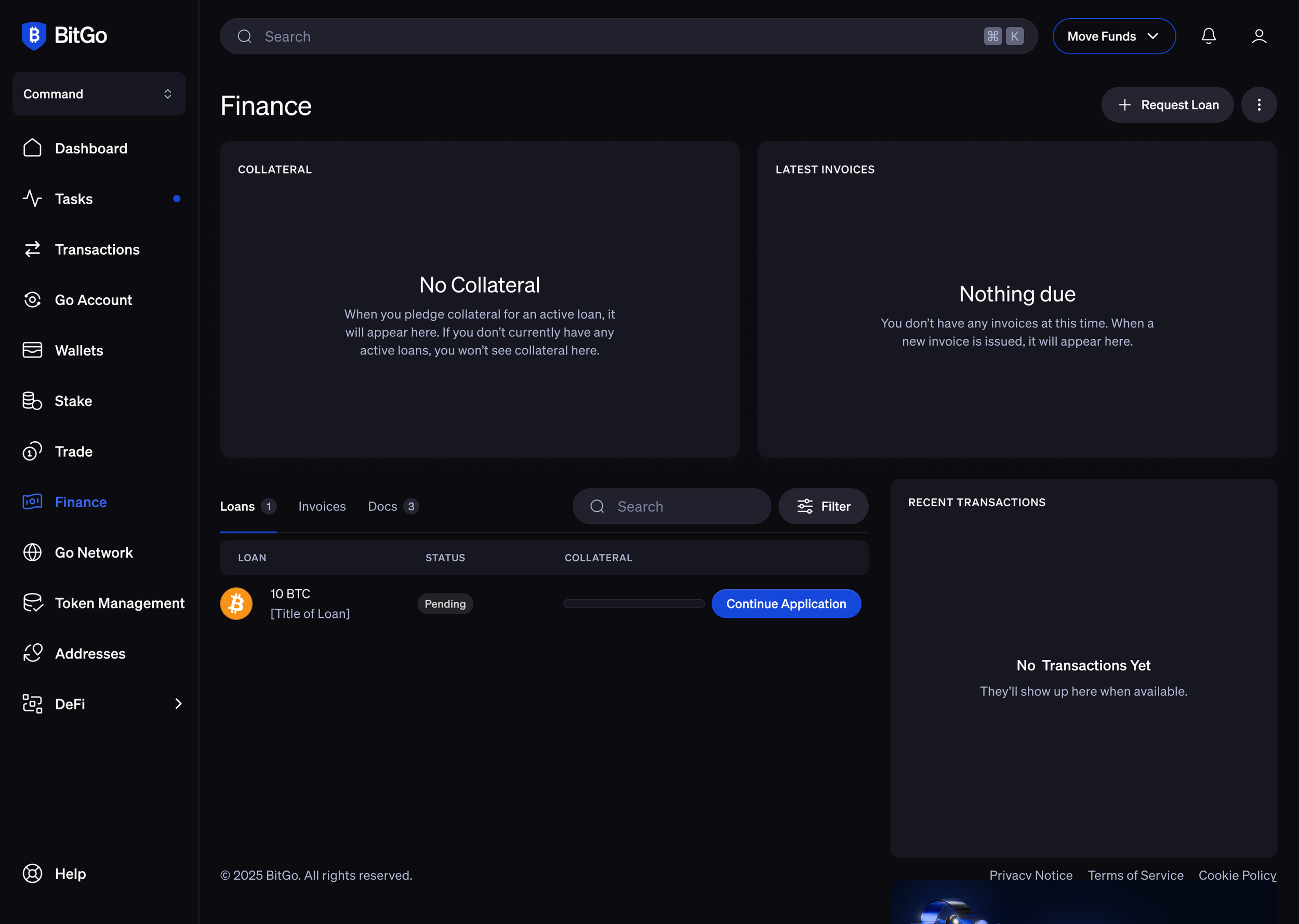

Client Experience - Final look

The final UI reflects multiple rounds of iteration based on feedback from product, engineering, compliance, and operations stakeholders. Each screen was refined to balance clarity, technical feasibility, and regulatory requirements.

Key focus areas included:

Simplifying complex workflows without losing critical detail

Improving information hierarchy for the borrower

Adjusting flows and layouts based on feedback and trade offs

These designs were validated through async reviews, working sessions, and Figma walkthroughs, evolving steadily from early concepts into a robust, production-ready experience for institutional lending.

Final look

The gallery below shows some key screens for the BitGo Verify app.

You can also check out the clickable prototype by clicking on the button below

Learnings

This project sharpened my ability to translate offline, fragmented workflows into clear, scalable product experiences. It also deepened my understanding of financial edge cases, regulatory design requirements, and cross-functional collaboration in high-stakes environments.

Future UX Opportunities

1.

Conduct structured usability testing with external institutional clients

2.

Include FAQs or contextual guidance within forms to support first-time institutional borrowers.

3.

Introduce a loan activity feed for internal teams to comment, tag, and coordinate without switching tools.